Best Homeowner Insurance in FL 2022

Best Florida Home Insurance

What is the average cost for homeowners insurance in Florida?

Florida has a subtropical climate, long coastlines, and sea views, making it a great place to live. But if you own a home in Florida, are thinking about buying one there, or are considering moving to Sunshine, Florida homeowners insurance is better than any other state.

Knowing the complexity will help you better understand how to purchase coverage. Due to the risk of widespread property damage, many private home insurance companies do not operate in Florida or only in very limited areas of the state.

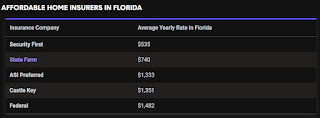

Understanding the challenges associated with Florida real estate insurance can help you set realistic expectations when buying homeowner insurance. According to Bankrate's average annual premiums, coverage available, and third-party customer satisfaction ratings, Florida's best home insurance companies include Travelers, Chubb, and Security First when covered by personal insurance.

The average cost of these standard policies in Florida is $ 250,000 for housing coverage, $ 1,353 per year, much like the national average of $ 1,312 per year. However, average charges vary significantly depending on the specific location in the state, the characteristics of your home, and the type of carrier you can get coverage for.

Why is homeowners insurance so high in Florida?

According to the Insurance Information Institute, Florida insurers suffered an underwriting loss of $ 1.6 billion in 2021. Roof fraud wasn't the only cause of higher premiums in 2022. Supply chain disruptions cause a shortage of building materials such as timber. Similarly, insurance companies pay more to rebuild their homes after making a claim.

Lawmakers are trying to find a solution by submitting a bill to open more companies that homeowners can choose from. If you're looking for the end of this premium crunch, Friedlander paints a dark picture.

"No matter what happens in the state legislature, insurance costs will continue to rise for at least two years from next year, which won't be resolved soon," Friedlander said. He recommends taking proactive steps to lower your insurance premiums.

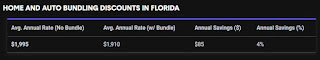

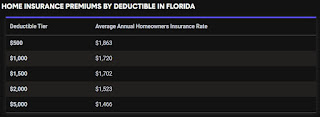

This includes adding windproof upgrades to your home, bundling home and car insurance, and increasing your insurance deductions.

How much is homeowners insurance in Florida a month?

The average cost of home insurance in Florida is $ 1,405 per year, or $ 118 per month. Premium costs aren't bad compared to the rest of the United States, but Florida residents pay an average of 5% more per year. The best way to get an affordable homeowners insurance policy in Florida is to get a quote from as many insurance companies as possible.

Unlike car insurance, homeowners insurance is not governed by state law. Still, there are big gaps in home insurance premiums by state. State premiums can vary based on the total number and value of homeowner claims filed in that particular state, depending on the value of the insured belongings and structures.

See the data below to learn more about typical Florida homeowners insurance premiums.

What home insurance is required in Florida?

Florida law does not require homeowners to buy insurance, but most people want to get insurance.

The biggest investment they can ever make – their home. In addition, if you own a specific pet or swimmer

Pools, some cities and counties may require liability insurance to cover other people's indemnified injuries.

Damage to their property for which you are legally liable.

For mortgages, most lenders require home insurance, including floods

To protect the collateral that secures the loan (if in a special flood zone).

There are different types of residential real estate policies to choose from. Type

Your purchasing policy depends on whether you own a single-family home, a townhouse, or a condominium.

Mobile home or rental property. If you rent your home from someone else, some sort of

Homeowner policy to protect your personal property, provide additional living expenses, and afford

Protection of personal responsibility. Each policy type provides coverage for a particular hazard or event.

Causes property damage under certain conditions.

Homeowner insurance policies typically provide the following coverage:

• Coverage A: Structure (house itself)

• Coverage B: Other structures (such as huts and fences)

• Coverage C: Moving property (contents of structure)

• Coverage D: Loss of use (also known as additional living expenses or ALE)

• Coverage L: Individual responsibility

• Coverage M: Medical expenses for others

The first four coverages listed are considered "property" coverage and are under Section I.

Your policy. Personal liability and payment of medical expenses to others are considered "responsibility" coverage and are covered.

It is under Section II of the policy.